Equip Your Financial Journey with Committed Loan Services

Equip Your Financial Journey with Committed Loan Services

Blog Article

Gain Access To Versatile Funding Solutions Designed to Suit Your Special Situation

In today's dynamic economic landscape, the value of accessing versatile funding solutions customized to specific circumstances can not be overemphasized. What exactly makes these versatile finance solutions stand out, and how can they really cater to your ever-evolving financial demands?

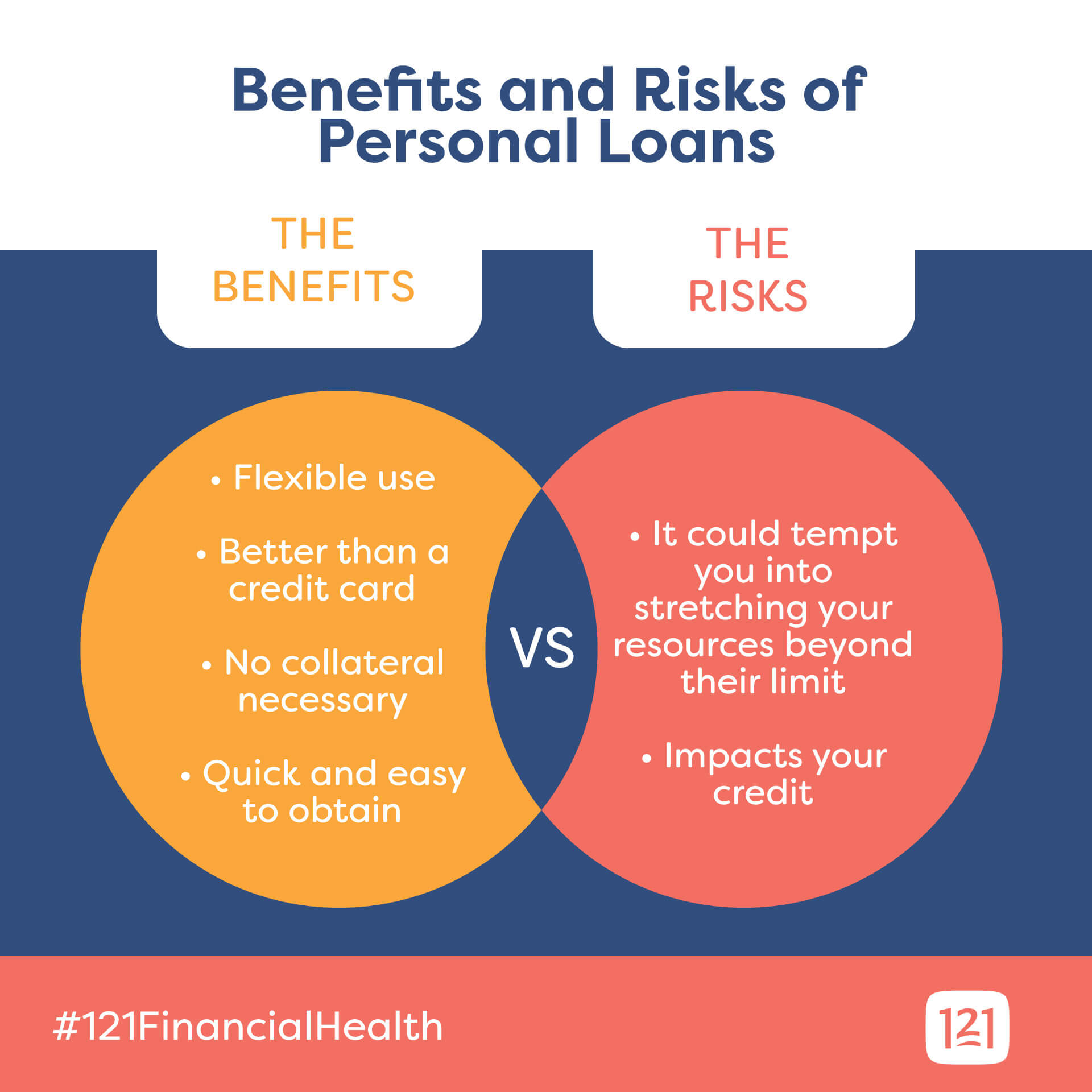

Advantages of Flexible Funding Provider

Adaptable financing services offer consumers the advantage of customizing repayment terms to suit their economic scenarios and goals. This degree of personalization provides a variety of advantages to debtors. It enables individuals to choose a payment routine that aligns with their revenue frequency, whether it be once a week, bi-weekly, or monthly. This flexibility makes sure that customers can comfortably handle their repayments without experiencing economic pressure. Second of all, customers can pick between set or variable rate of interest based upon their danger resistance and financial method. This option empowers customers to pick the most cost-effective service for their certain circumstance. Additionally, flexible lending services commonly offer the ability to make added repayments or repay the loan early without incurring fines. This feature enables borrowers to save on interest costs and accelerate their path to debt-free condition. Overall, the advantages of flexible car loan solutions offer borrowers with the devices they need to successfully handle their financial resources and accomplish their lasting financial purposes.

Understanding Your Borrowing Options

For people looking to fund greater education and learning, pupil finances present a viable alternative with versatile settlement strategies. Additionally, people with existing homeownership can utilize home equity financings or lines of credit report to gain access to funds based on the equity in their homes. Understanding these loaning choices allows people to make educated choices based on their financial objectives and circumstances, guaranteeing that they pick the most ideal loan product to satisfy their demands.

Tailoring Loan Terms to Your Requirements

When consumers analyze their financial requirements abreast with different financing choices, they can tactically tailor loan terms to fit their certain demands. Tailoring lending terms includes a thorough analysis of aspects such as the desired financing quantity, payment period, rate of interest, and any kind of additional charges. By understanding these elements, borrowers can discuss with lending institutions to create a car loan contract that straightens with their financial goals.

In addition, consumers can work out for versatile terms that enable for adjustments in instance of unforeseen monetary difficulties. This might consist of choices for repayment deferrals, funding expansions, or adjustments to the repayment routine. Inevitably, tailoring car loan terms to private demands can result in a much more convenient and customized borrowing experience.

Taking Care Of Payment With Convenience

To make certain a smooth and reliable repayment procedure, debtors should proactively plan and arrange their economic monitoring techniques. In addition, producing a budget that focuses on loan repayments can help in click over here handling finances effectively.

In instances where debtors encounter monetary difficulties, it is critical to connect with the lending institution promptly. Many lending institutions offer choices such as funding restructuring or short-term repayment deferments to aid individuals encountering obstacles. mca loan companies. Financial Assistant. By being transparent concerning monetary conditions, customers can work in the direction of equally advantageous options with the lending institution

In addition, it is helpful to check out chances for early payment if viable. Repaying the loan in advance of routine can decrease total passion prices and give economic alleviation in the long run. By remaining proactive, communicating freely, and checking out repayment approaches, consumers can effectively handle their funding obligations and accomplish monetary stability.

Protecting Your Financial Future

Protecting your monetary future is a critical aspect of attaining peace of mind and long-term stability. By developing a comprehensive financial plan, people can set clear objectives, develop a budget plan, conserve for emergency situations, invest sensibly, and safeguard their assets via insurance protection.

Moreover, diversifying your investments can assist reduce dangers and enhance general returns - mca loan companies. By spreading out investments across different property courses such as stocks, bonds, and real estate, you can reduce the impact of market variations on your profile. On a regular basis assessing and readjusting your economic plan as your situations alter is equally vital to remain on track towards your goals

Essentially, attentive financial planning is the structure for a protected monetary future. It provides a roadmap for accomplishing your goals, weathering unexpected challenges, and eventually appreciating monetary security and satisfaction in the years to come.

Conclusion

To conclude, adaptable funding services provide a range of benefits for consumers, offering customized options to match individual monetary situations. By recognizing borrowing options and personalizing lending terms, individuals can easily handle payment and safeguard their economic future. It is crucial to check out these adaptable car loan solutions to ensure a positive monetary result and accomplish long-lasting economic security.

Report this page